Sport Betting Market

Sport betting has evolved so much in recent years that many long time winning strategies are no longer profitable. As many gamblers are not yet aware of this, or are quick to write-off strategic ideas that span beyond conventional wisdom, I’ll discuss this using an easy to understand analysis of the “fade the public” betting system. Here I’ll explain why this system was profitable, and now, while still better than blindly picking teams, is no longer so. After reading this article you’ll have a better understanding of the current betting market and how you can profit from it.

The bottom line: Day trading has replaced sports betting as a form of entertainment for many Americans during the shutdown, and this phenomenon could partly explain the current disconnect between the economy (down) and the stock market (up). Go deeper: Sports betting.

Fade the Public Explained

Traditionally, the sports betting market was clasped amidst the battle of legalization, which still, in some regions, fights for legal identity, as money laundering instances and betting addiction raise concerns. Precisely how valuable the US sports betting market is remains up for debate. A report by Ibis World in 2018 roughly estimated that fully legal sports betting in the US would be worth an annual.

Fade the public simply refers to betting against popular teams. An example of how this system works, a professional sports bettor visits a sports bar and listens for, and perhaps participates in, discussions about various sporting events. His goal is to find out which teams the others in the bar are certain will cover the spread, and which teams have no chance. He repeats this process at other sports bars. Once he’s confident that there is a strong fan bias for a certain team to cover the spread, he makes a wager on the opposite side, “fading the public”. During the early to mid 0 decade, this was a highly profitable system, and many who used it with disciplined bankroll growth strategies grew wealthy. Unfortunately, for those still using the system, while it is better than blind picking teams, it is no longer a profitable system. To understand why, we need to first look at the reason “fade the public” once worked.

Why Fading the Public Once Worked

Fading the public worked at a time when betting point spreads and odds was largely based on fan biases. There were dozens of games each week where the bookmakers could predict which side of the game they expected to take the most bets on, and then set the line accordingly. For example, in baseball when the New York Yankees played the KC Royals, the bookmaker knew that no matter what odds he set, most bettors would take the championship favored Yankees over the perpetually cellared KC Royals. To make maximum profits, he’d set the odds so steep on the Yankees, that anyone betting the Royals was getting a better price than true odds and therefore had a bet with positive expectation (+EV). This worked because betting limits were small, and the bookmaker took far more Yankees bets than Royals bets.

To cover a little about betting limits, in 2003 the maximum bet on NFL sides ranged from $500 to $10,000 at each bookmaker, with the lower end of this range the most common. Whales with a proven track record were often allowed to bet more, while sharps (professionals) frequently found themselves either banned or only allowed to bet a fraction of the amount granted to others at each bookmaker. Bookmakers serviced mostly recreational players, and it was difficult for professionals to get considerable action; therefore, lines opened based on anticipated recreational action, and were adjusted based on recreational action as well.

Sports Gambling Market Size

Professional Friendly Betting Sites Changed the Market

Around 2004 or 2005, a handful of online betting sites realized the internet gambling boom was nearing its peak, at least in terms of new players registering to open accounts. While other sites were giving out massive cash bonuses and +EV bets to lock in new players, a couple sites changed their focus entirely. These sites decided that professional bettors, the ones they had recently spent time banning and limit collaring, were more profitable clients over the long term. This seemed a risky idea, but as long as lines were set correctly, the lopsided action didn’t matter too much, as the bookmaker would profit over the long haul from their theoretical hold, which is their term for what we gamblers call juice or vig.

Sports Betting Market Data

Just like that, things started to change. TheGreek.com in targeting pros adopted the slogan “sweat the game, not the payout”. Their model was that no matter how much you win, you’ll get paid timely and hassle free. They were one of the original professional friendly betting sites. Meanwhile, because professional sports bettors often sat waiting for betting lines to open, in hopes of spotting something of value to get first crack at, CRIS (also known as bookmaker.eu – use bonus code THEGEEK) began posting betting odds a full day before Las Vegas, while later adopting the slogan “where the line originates”. Pinnacle Sports, already known for professional friendliness, would take things to the next level by offering reduced juice -104 pricing on NFL sides, and -105 on other betting market. They were one of the first to compete on price by going against the standard $1.10 to win $1.00 -110 pricing model. Pinnacle stepped things up in other areas as well, offering unheard of betting limits, often $100,000 max per side, and lightning fast payouts. They even competed with CRIS by beating them to the punch on opening lines.

Today, these three companies remain the leaders in professional action, while Bookmaker.com is also quite friendly to the smaller player. TheGreek.com allows $5K max bets on NFL sides, bookmaker.eu offers 8 times that at $40K, and Pinnacle Sports essential has no limit. At Pinnacle, up to $30,000 can be bet at a time on NFL sides, and multiple maximum bets are allowed.

These professional betting sites cannot get away with the old tricks of shading a line to increase profit. In fact, they have to work quite hard to find a line where smart money no longer has interest in betting. The trick of their trade is moving the lines as bets come in until they have what is considered a “sharp line”. Once they have this, line fluctuation is minor and neither side is a plus EV bet.

Recreational Sites Must Follow Professional Sites

I need to call special attention to what I’ll cover next, as this is the area most fail to understand about the betting market. Today, while the number of professionals capable of capping well enough to spot value on opening lines is still small, there are literally thousands of well financed sports bettors, as well as those just starting to get a bankroll built, who understand how to cap the market. Let me put this into perspective with an example:

If Pinnacle sports is offering a team is -6 -104 while www.Bovada.lv is offering their opponent +6 +105, we have a situation where an arbitrage is possible. To take advantage of that, risk $1040 to win $1000 at Pinnacle on -6 -104, and risk $995.12 to win $1,044.88 at Bovada.lv at +6 +105, and no matter which team wins you profit $4.88. Considering there is no risk, bettors can risk a large portion of their bankroll. Remember, Pinnacle has the largest limits and lowest margins in the industry and is friendly to professional bettors. When these spots come up 95%, it is the other site not Pinnacle offering the +EV bet. If you’re not prone to risk, with proper bankroll management and growth strategy in place, you’d be better off betting only the Bovada +6 +105 line, rather than taking the arb.

To sum this up, there are thousands, if not tens of thousands, of gamblers who understand this same strategy. When recreational sites offer poor lines, as they used to do prior to the days of professional betting sites, it is now easy to see. Compare lines at Pinnacle, and bet anything that is off. As a result, when a recreational betting site tries shading the line, they end up being hit with an arsenal of small to midsized bets that force them to follow the same lead as professional sites. They need to adjust the line to the point where smart money or, more important to them, those following smart money, no longer have an interest.

It doesn’t matter if a site is professional or not. The line which was the last available prior to the game starting (the closing line) was a betting proposition where neither side was +EV. Fading the public might be better than blind picking teams, but in today’s betting market it will not result in a profit over the long term. If it does, there are two reasons: There is a factor the betting market hasn’t spotted yet, and this will correct itself in a matter of a week, or, more commonly, the bettor is experiencing short term variance which will regress towards the mean in time.

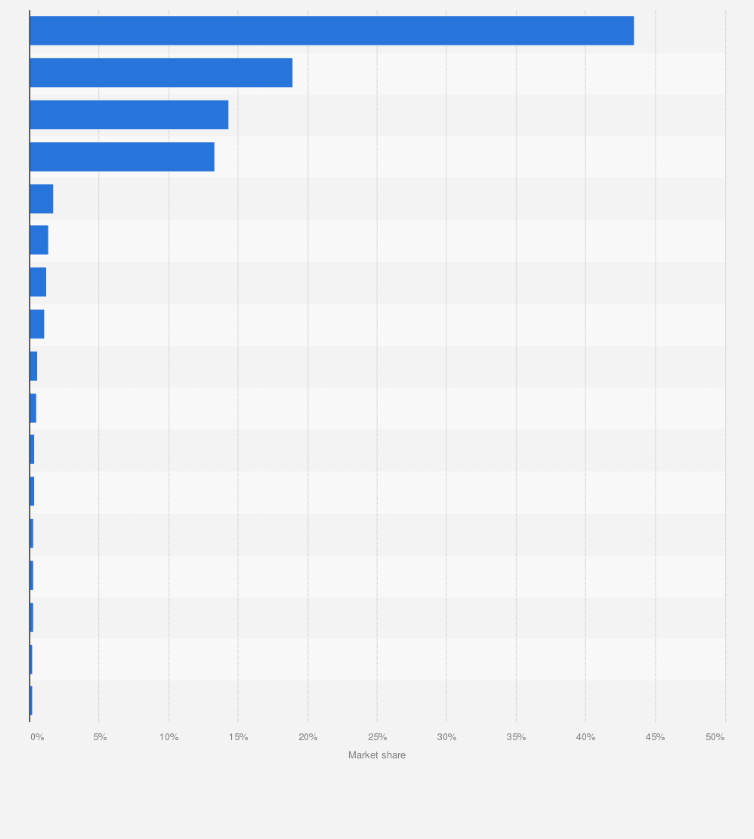

Sports Betting Market Share

For the same reasons that fading the public is no longer profitable, betting the small home underdog, the ranked favorite underdogs against non ranked favorites, or betting other systems that were profitable for years has also dried up. The reason in short: In today’s betting market, it is smart money, not recreational money, that moves the lines. In terms of dollars bet, smart money now greatly exceeds that of recreational money, and this is by a wide margin.

Winning in the Current Betting Market

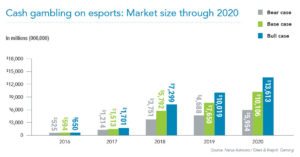

Sports Betting Market Growth

Perhaps the most profitable non handspring intensive approach to winning in the current betting market is derivative betting. A derivative is a betting market derived from a larger betting market. For example, one of my favorite prop bets in NFL football is which team will score first. This prop is a close derivative of the betting line on the game’s first half total and point spread. Some other examples: in baseball, Runs + Hits + Errors betting is a derivative of the odds maker’s posted total; in hockey, the puck line is a derivative of the moneyline, etc. These are profitable because while large markets are constantly adjusting towards efficiency, the derivative market often lags behind. I cover this strategy for a specific mid market prop, in the article about “NFL Prop Betting”.

The second most effective way to profit in the current betting market is with teasers. I’ve covered these in great detail in the teaser betting guide. Teasers betting strategy is not difficult to learn and a great place to get started finding +EV bets.

Finally, let me conclude by telling you, every strategy article here at TheSportsGeek.com is up to date. Unlike most strategists who will regurgitate low level strategy that often doesn’t work, or is outdated, our articles are relevant to the current betting market. They are all written by professional bettors with long term, and current, winning track records. If you appreciate these tips, please support us by opening an account using this link to www.bookmaker.eu. Thanks for taking the time to read this article and as always, we wish you the best of luck.

Dublin, Aug. 31, 2020 (GLOBE NEWSWIRE) -- The 'Sports Betting Market - Forecasts from 2020 to 2025' report has been added to ResearchAndMarkets.com's offering.

The sports betting market was valued at US$85.047 billion in 2019.

The sports betting market is projected to witness considerable growth primarily on account of the inclination of the governments of numerous countries towards the legalization of sports betting. Furthermore, the rising penetration of various legal online platforms in some countries is also further supplementing the sports betting market growth in the near future.

The market is also poised to grow on account of the rising popularity of international sports events around the globe coupled with the increasing popularity of high-end sports such as cricket, soccer, baseball has gained a lot of traction in the past years, which has led to a decent increase in the sponsorships for clubs, teams, players.

Additionally, the rising investments by numerous sports organizations in marketing and promotional activities have led to increased investments by major betting companies in providing sponsorships for sports teams around the globe. Thus, the rising commercialization of sports events is considered to be a key factor that is expected to positively impact the market growth during the next five years.

The rising consumer expectations have led to the constant participation of key players of the market in the form of partnerships, collaborations, agreements, and R&D for the launch of various platforms to cater to the rising consumer expectations. For instance, recently in June 2020, Sportech PLC a leading market player in the gaming technology industry of the world announced its strategic partnership with a French gaming operator ZeTurf, the aim of this partnership was to deliver attractive and alternative options for betting on French racing.

Similarly, in May 2020, the company announced a successful launch of Tote Betting services in Moscow for client Pari Engineering Rus. Furthermore, the growing partnerships between high end-resorts and casinos with leading market players for availing their services also shows the potential for the market to grow in the near future.

For example, in February 2020, William Hill, a leading sports betting company entered into a long-term partnership agreement with the Grand Traverse Band of Ottawa and Chippewa Indians (GTB), a federally recognized Indian tribe for exclusively providing online sports betting and online casino gaming throughout Michigan. Also, during the same month, the company also entered into a partnership with CBS Sports with an aim to increase the reach to millions of new sports fans and fantasy players by extending its leadership in sports betting content.

Moreover, in February 2019, Churchill Downs Incorporated entered into a partnership agreement with Golden Nugget Casino for the launch of its BetaAmerica online real-money sports betting and online casino platform in New Jersey.

However, the sports betting market may be restrained by the fact that still sports betting is considered to be an illegal activity in some parts of the world. Also, the recent outbreak of the novel coronavirus is expected to be a major factor inhibiting the market growth during the short run as the intense outbreak has led to enforcement of directives by the WHO such as social distancing and quarantine measure in almost every country of the world.

This has led to the temporary suspension or cancellation of all the major sports events at international, regional, and national levels that include, football, hockey, marathons, cricket, basketball, and more. This is considered to be one of the prime factors that is projected to hamper the market growth for the next ten to eleven months.

Growing legalization is offering lucrative opportunities

One of the major factors that is propelling the market growth opportunities is the rising government initiatives for the legalization of sports betting with an aim for the generation of revenue. For instance, in 2018 sports betting for the first time was legalized in New Jersey. Furthermore, the inclination of governments of various developing countries such as India and Brazil among others to tap the potential of revenue that the sports betting industry holds is considered to be a prime opportunity for the market to grow in the near future. For example, in 2018, the Law Commission of India stated in its report the recommendations for legalizing sports betting in the country.

The global sports betting market has been segmented on the basis of platform, sport, and geography. By platform the segmentation of the market has been done on the basis of online and offline. By sport the market has been classified into cricket, FIFA, horse racing, and others. Geographically, the segmentation of the sports betting market has been done into North America, South America, Europe, Middle East and Africa, and Asia Pacific.

Online segment to witness a decent growth

By platform, the online segment is projected to witness a healthy growth during the next five years. The rapid internet and smartphone penetration coupled with the launch of new online betting platforms are some of the key factors bolstering the growth of this segment throughout the forecast period.

Europe to hold a notable share

Geographically, the European region is anticipated to hold a substantial share in the market throughout the forecast period primarily on account of the legalization of betting in several European countries. Also, investments by players in countries of this region for expansion of services further supplement the market growth in Europe during the next five years.

Competitive Insights

Prominent key market players in the Sports Betting market the 888 Group, Kindered Group plc, Wiliam Hill PLC, and Churchill Downs Incorporated among others. These companies hold a noteworthy share in the market on account of their good brand image and product offerings. Major players in the Sports Betting market have been covered along with their relative competitive position and strategies. The report also mentions recent deals and investments of different market players over the last two years.

Key Topics Covered

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.4. Industry Value Chain Analysis

5. Sports Betting Market Analysis, By Platform

5.1. Introduction

5.2. Online

5.3. Offline

6. Sports Betting Market Analysis, By Sport

6.1. Introduction

6.2. Cricket

6.3. FIFA

6.4. Horse Racing

6.5. Others

7. Sports Betting Market Analysis, By Geography

7.1. Introduction

7.2. North America

7.3. South America

7.4. Europe

7.5. Middle East & Africa

7.6. Asia-Pacific

8. Competitive Environment and Analysis

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. Company Profiles

9.1. the 888 Group

9.2. Kindred Group plc

9.3. William Hill plc

9.4. Churchill Downs Incorporated

9.5. Sportech plc

9.6. The Stars Group Inc.

9.7. Webis Holdings plc

9.8. Flutter Entertainment plc

For more information about this report visit https://www.researchandmarkets.com/r/lkiuog

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.